New Year's Eve is a time for reflection about the year past and the year ahead. How anyone can do that, inebriated, in with a group of other inebriated people, with party hat on and blow-out noisemaker going, is a topic for another day. This morning, my wife and I celebrated New Year's, in our usual manner, by getting a dozen donuts. If you should ever ask me why this last day of the year is different from all other days, I will say it's the donuts.

Not being inebriated, then, I am capable of reflection in complete sentences. Right now, I'm reflecting about my reasons for buying the five stocks that I currently own. While not as analytic as a chart or balance sheet, the matter of what was I thinking when I bought these stocks might provide the earnest reader with a useful and corrective homily for his own trading behavior.

Conoco Philips (COP)

In my investing career, I have gone from fearful to foolhardy. In the case of oil stocks, back in 2004, I bought only piddling amounts of Cimarex and Encana, because I was fearful of oil. I was fearful because I listened to Cody Willard, a real westerner, tell about the inevitable tendency in the oil business to go boom and then go bust. Crude oil was then booming through $50, on its way to $147. Even $50 was, to Willard, a boom of such historic proportion that the bust must be coming soon with devastating effect on those left holding the barrel. Willard was a smart guy on Cramer’s website, and his uncle had stories to tell about the wildcatting days. Nevertheless, I bought a little oil because Cramer was pounding the table about the sector, but Cody made me scared to risk a substantial amount of capital, or hold the shares long enough for them to go through the roof. Result: I made a couple of thou, but left the big money on the table.

Now, I am both wiser and more foolhardy – in 2008, I acquired a starter position in Conoco because Cramer, still high on oil, was buy-buy-buy on it, along with everybody else. Over time, with a little success, my confidence grew and my fearfulness subsided, and I increased my stake to a couple of thousand shares. And I’m still holding them. Here at year’s end, with a cost-basis of $51.99, I’m up 32%, and the intermediate outlook for oil stocks is great, especially Conoco. It’s a sure thing, if you’re patient.

Nevertheless, Cody was right: Oil did go boom to $147, before going bust, but he made his call at $50, on the way up. So the early bird was way too early, and got the shaft. But I wonder how many people rode it all the way up and then rode it all the way back down. I sat it out the first time, but this time I’m on board. As always, the trick will be to know when to get off.

But I’m not worried. This time up, we have a road map: $90 oil to $100, and then, eventually, back to $147. The wise will get off somewhere between $110 and $147. The foolhardy will ride the thing all the way up and then (one would hope) bail somewhere on the terrifying ride back down. (Of course, the market reserves the right to change the road map at any time.)

Oil Services (OIH) (posted on 1/11/2011)

In March of last year, I decided to increase my exposure to the oil sector: I bought 500 shares of Exxon Mobil (XOM). Exxon is a supertanker of a company and slow to move - for the rest of the year, it basically went nowhere, while Conoco went up smartly. Daniel Dicker, on Cramer's web site, recommended Exxon over Conoco at year's end precisely for this reason - the slow will later be fast. So what did I do? I sold my Exxon in December, mainly from boredom, making about 17% on the transaction. Then, last week, I bought 400 shares of the oil services ETF (OIH). I did this on the recommendation of both Joe Terranova and Pete Najarian on the stock channel's Fast Money show. So far, OIH is not boring: the day I bought it, it closed up a buck from my purchase price; then, yesterday, it closed down a buck and six bits. Today, it has been up as much as $4, and now, around 3:30 PM, it is still up about $3. For an ETF, this sucker moves!

ATP Oil and Gas (ATPG) (posted on 1/12/2011)

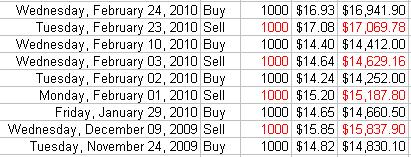

Another oil. I first heard about about ATPG from a trader on Cramer's website. The story was that it was a hated stock with a very high short interest because the company was deeply in debt, trying to pull off a big coup with new technology for drilling offshore in holes abandoned by other big oil companies. If the company went bust, you would lose all your shekels, but if it succeeded, the stock could go from $15 to $75 in a hurry. I liked the story. So I read more about it on YAHOO's ATPG message board: there appeared to be a lot of posters with experience in the oil business who were betting the farm on success, but they were saying that you had to be patient. I can be patient, so I bought 1000 shares in November, 2009, and traded them between $12-14 to pick up a few thou. Then some good expectations surfaced and the stock shot up to $23. On the way up, I bought another 1000 shares at $20.42. I should have stood in bed. Shortly thereafter, the BP oil spill fracas occurred and the stock went to 9, fast. Suddenly, I was $10,000 in the hole, but I held on, trading between $9-14, to reduce my loss a bit, giving me a cost basis of $15.68 on 2000 shares. When BP's hole got plugged, ATPG recovered slowly, hampered by the headwind of the moratorium on drilling in the gulf. When the moratorium ended and ATPG was cleared to resume drilling, the stock started to move back up. It is now trading above $17 and my stake is back above water. I remain a believer and am holding the stock. It's a slow train coming, but Hallelujah Land is up around the bend.

(To be continued, with C and GOOG.)