I know today is Friday.

It's not Saturday or Sunday because the stock market is open.

It's not Monday because I'm not celebrating the end of the weekend.

It's not Tuesday or Wednesday or Thursday because I'm not thinking that next weekend is still a few days away.

I know it's Friday because I take the trash out on Thursday evening and, this morning, my empty trash can is in the middle of the street.

Friday, March 19, 2010

Tuesday, March 2, 2010

Smart Money

The smart money, which is to say the guys who predicted the Dow would go to 5,000 in 2008, is now saying that GOOG is destined for 480 soon.

Yesterday's action made me think that we have seen the near term low at 520. Today's action - up 9 plus - makes me think I'm right. If GOOG closes strong (9+), I'll be reasonably certain of it.

The smart money doesn't see it that way.

Yesterday's action made me think that we have seen the near term low at 520. Today's action - up 9 plus - makes me think I'm right. If GOOG closes strong (9+), I'll be reasonably certain of it.

The smart money doesn't see it that way.

Monday, March 1, 2010

Sermonette

To the Lord let praises be.

It's time for dinner now let's go eat.

My little sermon for today has for its text the homily:

Never let a trade turn into an investment.

What does this mean? It means you should never deceive yourself into thinking that a dinky little stock you just bought for a few days is, in fact, a long-term investment, long enough at least for you get all your shekels back. It expresses the wisdom that this is a recipe for riding a loser all the way to the ground.

I confess that I have deluded myself in just this way, more than once. And I repent of it. However, my experience has shown me that the rule only applies to stocks that are losers. If your stock goes down just because it is temporarily in what Cramer stoops to call the Bow-Wow Chateau, then, I humbly suggest, that you have a recipe for selling out at the bottom.

A more comprehensive strategy would allow an investment to be held as a trade if the outlook is bright in the near term, but as an investment, even if the near term is grim, if the long term is great. And it would be allowable to change a trade into an investment or an investment into a trade, as the situation warrants.

I have applied this strategy to trading-and-investing ATPG. I am now in investment mode, but am constantly re-evaluating the situation, going forward, to determine if I should go back into trade mode.

So far, I have been successful with this strategy. But, considering that I am an undisciplined trader, I have not been playing with enough shekels to really hurt myself.

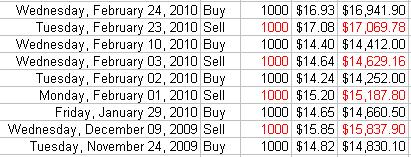

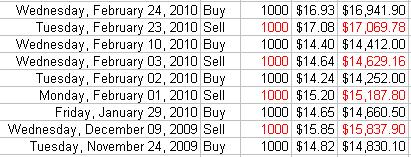

ATPG Trades

It's time for dinner now let's go eat.

My little sermon for today has for its text the homily:

Never let a trade turn into an investment.

What does this mean? It means you should never deceive yourself into thinking that a dinky little stock you just bought for a few days is, in fact, a long-term investment, long enough at least for you get all your shekels back. It expresses the wisdom that this is a recipe for riding a loser all the way to the ground.

I confess that I have deluded myself in just this way, more than once. And I repent of it. However, my experience has shown me that the rule only applies to stocks that are losers. If your stock goes down just because it is temporarily in what Cramer stoops to call the Bow-Wow Chateau, then, I humbly suggest, that you have a recipe for selling out at the bottom.

A more comprehensive strategy would allow an investment to be held as a trade if the outlook is bright in the near term, but as an investment, even if the near term is grim, if the long term is great. And it would be allowable to change a trade into an investment or an investment into a trade, as the situation warrants.

I have applied this strategy to trading-and-investing ATPG. I am now in investment mode, but am constantly re-evaluating the situation, going forward, to determine if I should go back into trade mode.

So far, I have been successful with this strategy. But, considering that I am an undisciplined trader, I have not been playing with enough shekels to really hurt myself.

ATPG Trades

Subscribe to:

Posts (Atom)