GOOG closed above $640. That level should hold, this close to earnings.

The rest of the list, except for ATPG, did well.

The portfolio closed out the month up 0.99%.

Saturday, March 31, 2012

Thursday, March 29, 2012

Wednesday, March 28, 2012

GOOG steps up

GOOG papered over the piss-poor performance of the rest of the portfolio today with a strong gain of 1.35%.

That held the loss in the whole list to a measly 0.12%. May all my losses be measly.

That held the loss in the whole list to a measly 0.12%. May all my losses be measly.

Tuesday, March 27, 2012

The Red Sea

Nothing but red today. Not unexpected after a big green day like yesterday.

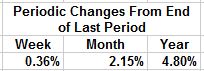

We're still up 0.36% for the week, 2.15% for the month, and 4.80% for the year.

We're still up 0.36% for the week, 2.15% for the month, and 4.80% for the year.

Monday, March 26, 2012

GLD Star Day!

Gentle Ben Bernanke may not be the most exciting guy on TV, but he sure got the market revved up today—the old portfolio made a good showing after he made an early speech.

At noon, the Fast Money guys (including ex-officio member, Dennis Gartman) all agreed that stocks are heading higher and they were unanimous in their praise for gold, as represented in the GLD ETF, which is significantly off its highs of last year. So I took half my cash hoard and bought some, giving it an allocation of 2.3% among its peers. I missed most of the move for the day, but closed up from my purchase price.

The numbers for the month and the year are looking good.

At noon, the Fast Money guys (including ex-officio member, Dennis Gartman) all agreed that stocks are heading higher and they were unanimous in their praise for gold, as represented in the GLD ETF, which is significantly off its highs of last year. So I took half my cash hoard and bought some, giving it an allocation of 2.3% among its peers. I missed most of the move for the day, but closed up from my purchase price.

The numbers for the month and the year are looking good.

Friday, March 23, 2012

Thursday, March 22, 2012

Wednesday, March 21, 2012

Tuesday, March 20, 2012

A Down Day to Love

This was the bears' chance to take the market down and they failed. The selling dried up mid-morning, and the portfolio closed down just a fraction of what it had been earlier in the day.

GOOG held on to almost all of yesterday's big gain---a victory.

The rest were down fractionally, except for C which bucked the trend with a gain of $0.91 (2.45%). Some heavy accumulation going on there.

Analysts, invited to propound their theories on the Stock Channel, are actively promoting going long both COP and C at their current levels.

GOOG got an honorable mention on Cramer's site.

GOOG held on to almost all of yesterday's big gain---a victory.

The rest were down fractionally, except for C which bucked the trend with a gain of $0.91 (2.45%). Some heavy accumulation going on there.

Analysts, invited to propound their theories on the Stock Channel, are actively promoting going long both COP and C at their current levels.

GOOG got an honorable mention on Cramer's site.

Monday, March 19, 2012

The Market is Fluctuating to the Upside

Gold Stars today for all except OIH and DE, which were essentially flat to the downside. GOOG and COP were strong. C continues to surprise to the upside.

Collectively, the stocks currently in the portfolio are showing a profit of 11.28%. These are levels where an old man's fancy turns to thoughts of selling something, but I'm resisting those thoughts---I think this rally has legs and room to run. I want to see GOOG at $700 and COP at $90 before I take the money and run.

I'm heartened by the fact that so many of the smart guys, like Doug Kass (who is always the first to arrive at every party and the first to leave), are expecting a big correction.

Collectively, the stocks currently in the portfolio are showing a profit of 11.28%. These are levels where an old man's fancy turns to thoughts of selling something, but I'm resisting those thoughts---I think this rally has legs and room to run. I want to see GOOG at $700 and COP at $90 before I take the money and run.

I'm heartened by the fact that so many of the smart guys, like Doug Kass (who is always the first to arrive at every party and the first to leave), are expecting a big correction.

Saturday, March 17, 2012

By New Moon in April

This market wants to run. The Fast Money guys were talking about a "wall of money" coming from the bond market to equities. The turn in treasuries has been called by traders for some time now---maybe this is the time.

It feels like it---all my sailors had the wind at their backs all day today. The good ship Portfolio moved 1.06% in a northerly direction. We're heading for Hallelujah Land by new moon in April.

It feels like it---all my sailors had the wind at their backs all day today. The good ship Portfolio moved 1.06% in a northerly direction. We're heading for Hallelujah Land by new moon in April.

Thursday, March 15, 2012

A Gold Star for C

On the whole, a good, constructive day for all save COP, which disappointed. GOOG and C, clearly rising on strength, made up the difference, with assistance from OIH, giving the portfolio a boost of 0.25%.

Special thanks, again, to C, which stood out, percentage-wise.

Special thanks, again, to C, which stood out, percentage-wise.

Wednesday, March 14, 2012

Fly the Flag of Defiance

It was a bloody fight, but our stalwart stock johnnies stood in the breach and fought back the bears, while taking hits all around. In the end, the redoubt was defended and Fort Portfolio retained two-thirds of the gain that it recorded yesterday.

Tuesday, March 13, 2012

How've you been!

Somebody, somewhere, yelled, "Buy everything!" this morning and we were off to the races. Everything in my honking list closed up big, with my problem, er make that prodigal, children, DE, C and ATPG, leading the way.

The portfolio was up a whopping 1.85%.

Would it be too much to hope for a few more days like this?

The portfolio was up a whopping 1.85%.

Would it be too much to hope for a few more days like this?

Monday, March 12, 2012

Nearly Naught

GOOG bouncing off $600 like a red, rubber ball.

COP finding a base above $77.

DE and OIH again, into the abyss

C struggling to make a living.

The portfolio barely budging.

COP finding a base above $77.

DE and OIH again, into the abyss

C struggling to make a living.

The portfolio barely budging.

Friday, March 9, 2012

Squadling

There's a word for you—the portfolio has been squadling for the last couple of weeks. Combination squat and straddle. The bears are desperately trying to bring this market down. Brave C keeps motoring.

Thursday, March 8, 2012

Wednesday, March 7, 2012

DE up nothing

The portfolio treaded water today, staying afloat, up 0.67%.

DE is sitting on the bottom, up nothing.

COP won't go down.

DE is sitting on the bottom, up nothing.

COP won't go down.

Tuesday, March 6, 2012

Hard Hats Recommended

We're in hunker down mode now. The idea now is to buy back my shares of COP for less than I sold them last week. Not much money involved. It's a game—success would make me feel like I'm winning.

The performance of the portfolio was dismal.

It's time to kick back and dream a little dream of Hallelujah Land.

The performance of the portfolio was dismal.

It's time to kick back and dream a little dream of Hallelujah Land.

Monday, March 5, 2012

A drubbing

The decline was orderly. That's all I can say for it.

Still, COP closed a buck up from where I sold it last week.

Portfolio off 0.91%.

Still, COP closed a buck up from where I sold it last week.

Portfolio off 0.91%.

Friday, March 2, 2012

ATPG rides a wave

Today ATPG, struggling against the tide, went where it has gone several times before. I've been way up and I've been way down with this stock. It's a roller coaster named Chernobyl. What's a Chernobyl worth these days? I mean, if it cleaned up its act.

The portfolio suffered a loss of 0.09%, while the Vanguard Total International Stock Index Fund increased by 0.81%. What am I doing here? I feel so unnecessary.

(Erratum: the change should be from 3/1/2012.)

The portfolio suffered a loss of 0.09%, while the Vanguard Total International Stock Index Fund increased by 0.81%. What am I doing here? I feel so unnecessary.

(Erratum: the change should be from 3/1/2012.)

Thursday, March 1, 2012

Was that the dip?

Yesterday, COP sold off just enough to tease me out of a few shares. Today, it came roaring back, but I don't care. It was a sterling day, all the way around.

The value of the portfolio increased by 1.13%.

The value of the portfolio increased by 1.13%.

Subscribe to:

Comments (Atom)