...so goes the portfolio. GOOG got slammed today (don't ask). It closed down a tad over 8%. The portfolio closed down a tad over 3%.

It's OK - GOOG is fine. Just a hiccup on the way back to Hallelujah Land.

Thursday, October 18, 2012

Wednesday, October 17, 2012

Google Eve

It's Google Eve once again, and the faithful are gathering together in small groups or at home with loved ones to reflect on the blessing that is Google and swap stories of joy and regret that have come their way over the years.

The stock, GOOG, has been on a long run, achieving one all-time high after another, and consolidating its gains on small pullbacks that strengthen its trajectory. We don't know what tomorrow will bring, but we're not worried about that now. We simply look forward to the future when we will all become filthy, stinking rich.

The stock, GOOG, has been on a long run, achieving one all-time high after another, and consolidating its gains on small pullbacks that strengthen its trajectory. We don't know what tomorrow will bring, but we're not worried about that now. We simply look forward to the future when we will all become filthy, stinking rich.

Monday, September 24, 2012

Hallelujah Land!

Tell the folks back home

it's the Promised Land calling

and the po' boy's on the line

For Google shareholders, it has been frustrating for the past five years to see the stock held back, while its competitors have soared, simply because traders don't understand Google's unique genius.

Today, however, is a day to savor, because Google has hit an all-time high, at a time when all its competitors are being sold off with a vengeance.

File under: every dog has its day.

it's the Promised Land calling

and the po' boy's on the line

For Google shareholders, it has been frustrating for the past five years to see the stock held back, while its competitors have soared, simply because traders don't understand Google's unique genius.

Today, however, is a day to savor, because Google has hit an all-time high, at a time when all its competitors are being sold off with a vengeance.

File under: every dog has its day.

Friday, August 24, 2012

VRNG is disgusting, but I own a bit of it

GOOG touched $680.45, a 52-week high this week, then dropped back a cupla points. Looking good.

GLD broke out this week, hitting $162.33, also looking good.

Added a small-cap flyer, VRNG, a disgusting little patent troll, that is suing GOOG for everything. Small position - 0.12%.

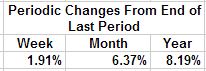

Portfolio down fractionally on the week, but up 3% on the month, and 1.32% on the year.

I'm glad I don't have to look at ATPG anymore.

I'd like to buy back DE for a much lower price, but it keeps going up.

I have a 16.39% cash stash now and intend to be very patient in deploying it.

GLD broke out this week, hitting $162.33, also looking good.

Added a small-cap flyer, VRNG, a disgusting little patent troll, that is suing GOOG for everything. Small position - 0.12%.

Portfolio down fractionally on the week, but up 3% on the month, and 1.32% on the year.

I'm glad I don't have to look at ATPG anymore.

I'd like to buy back DE for a much lower price, but it keeps going up.

I have a 16.39% cash stash now and intend to be very patient in deploying it.

Saturday, August 18, 2012

Humble Pie don't taste good

This past week, on a disappointing earnings report from DE, I sold my entire position. I also sold a fifth of my COP stake and threw out my nearly worthless position in the soon-to-be bankrupt ATPG.

Despite all this, the portfolio ended the week with an increase of 1.33%, which was entirely due to the meteoric rise in my now diminished GOOG stake.

Yay for GOOG.

Despite all this, the portfolio ended the week with an increase of 1.33%, which was entirely due to the meteoric rise in my now diminished GOOG stake.

Yay for GOOG.

Friday, July 27, 2012

My GOOG curse lifted

I've been waiting for a long time for GOOG to put a floor under $600 and make an assault on its all-time high. Each time, it fell through the floor like a Higgs boson.

Now, that I have sold 100 shares at $601 from the position I've held for the past 2 1/2 years, GOOG appears to have taken off, soaring $33 in the past three sessions, while I am left with seller's remorse.

Meanwhile, ATPG appears to be headed for zero.

Now, that I have sold 100 shares at $601 from the position I've held for the past 2 1/2 years, GOOG appears to have taken off, soaring $33 in the past three sessions, while I am left with seller's remorse.

Meanwhile, ATPG appears to be headed for zero.

Wednesday, July 25, 2012

Action Taken

Yesterday, in after hours trading, I sold 20% of my GOOG position to raise cash for picking up a little AAPL on the cheap.

AAPL was down 4.32% from yesterday's close, following a rare, but substantial earnings miss. I aim to bide my time, looking for a good entry point.

AAPL was down 4.32% from yesterday's close, following a rare, but substantial earnings miss. I aim to bide my time, looking for a good entry point.

Friday, July 20, 2012

GOOG Holds Gain

Today, GOOG held on to its after hours gain from yesterday to close at $610.82. Since Google Eve, GOOG has added just over $30 to its share price. It has now retaken the high ground, setting itself up for yet another run at $700. Google's relentless earnings growth keeps raising the bar, despite constant skepticism from traders.

Ex GOOG, the rest of the portfolio turned in a net wash performance with COP and C leading on the downside, and DE, OIH and SD adding upside, while ATPG continued to melt like an ice cube in the sun.

Nevertheless, thanks to GOOG, the portfolio eked out a gain of 1.13% on the day, bringing the weekly and monthly percentages, refreshingly, into the plus column.

Ex GOOG, the rest of the portfolio turned in a net wash performance with COP and C leading on the downside, and DE, OIH and SD adding upside, while ATPG continued to melt like an ice cube in the sun.

Nevertheless, thanks to GOOG, the portfolio eked out a gain of 1.13% on the day, bringing the weekly and monthly percentages, refreshingly, into the plus column.

Thursday, July 19, 2012

GOOG Pops!

It's been a while since GOOG popped after hours without fading into a loss. Tonight, after a good report, GOOG initially ran up to around $613 and then fell back to around $605, only to creep slowly back up.

Lookin' good.

Lookin' good.

Wednesday, July 18, 2012

Google Eve

The second quarter is usually weak for GOOG, although the company has never turned in a bad quarter - it's just that the analysts' guesses are not very good during the summer. Anything could happen tomorrow.

Tuesday, July 3, 2012

Risk On!

It's beginning to appear that this correction bottomed about two weeks ago when Goldman Sachs recommended shorting the S&P 500. I love it when the smart guys are caught leaning the wrong way. I hope it doesn't happen to me.

The portfolio remains 96% invested in equities. Recent additions, KMR and ECA, are up 10 and 13 percent respectively.

The portfolio remains 96% invested in equities. Recent additions, KMR and ECA, are up 10 and 13 percent respectively.

Friday, June 29, 2012

Thursday, June 28, 2012

Wednesday, June 20, 2012

Tuesday, June 19, 2012

Friday, June 8, 2012

Comment

The portfolio was up a smidgen, today.

Recent changes:

I bought small positions in SD and KMR, which is the same thing as KMP, except better and cheaper.

Yesterday, I sold a bit of COP, to keep my hand in and raise a little cash.

Recent changes:

I bought small positions in SD and KMR, which is the same thing as KMP, except better and cheaper.

Yesterday, I sold a bit of COP, to keep my hand in and raise a little cash.

Wednesday, June 6, 2012

Comment

Everything up big today—short covering rally.

Saturday, June 2, 2012

Tuesday, May 29, 2012

Life after Memorial Day

GOOG popped, then fizzled, but the rest of the pack, sans GLD, were up smartly.

The portfolio was enhanced by 1.28%.

The portfolio was enhanced by 1.28%.

Tuesday, May 22, 2012

Signs of Yahweh

There are forces at work, keeping GOOG above $600.

Today, around 2:30, GOOG slipped below the magic cabalistic number, $600. At ten to four, it reached a low of $596.00. Then, it began to rise in a graceful, upward arc, coming to rest at the close with a price of $600.80. This can only be the work of Yahweh. For once, Yahweh's Will and my own preferences were in perfect alignment.

Today, around 2:30, GOOG slipped below the magic cabalistic number, $600. At ten to four, it reached a low of $596.00. Then, it began to rise in a graceful, upward arc, coming to rest at the close with a price of $600.80. This can only be the work of Yahweh. For once, Yahweh's Will and my own preferences were in perfect alignment.

Monday, May 21, 2012

Back to where we once belonged

A sterling day for all, possibly at the expense of Facebook.

The whole portfolio gained a whopping 2.31%.

The whole portfolio gained a whopping 2.31%.

Wednesday, May 16, 2012

A few lousy days later

The only thing up today was GOOG, and it was way up: almost $18. Not sure why—some noise this morning about Google taking control of the Android platform that roused the short sellers from their slumbers. Technically, GOOG is looking way better than AAPL—I'm going to enjoy it while I can.

A while back, I made the rash statement that GOOG had moved into a new range between $600 and $900, and would not fall below $600 again. I was immediately rebuked by the market (Yahweh). But now (timing is everything!), I believe that a floor at $600 is in place, at least for the time being.

A while back, I made the rash statement that GOOG had moved into a new range between $600 and $900, and would not fall below $600 again. I was immediately rebuked by the market (Yahweh). But now (timing is everything!), I believe that a floor at $600 is in place, at least for the time being.

Tuesday, May 8, 2012

Not bad for a lousy day

Today started out bad, but when the dust settled, my three largest holdings---GOOG, COP and DE---made very decent gains. The portfolio was up a respectable 0.63%.

By the way, last Tuesday, COP spun off PSX shares on a one for two basis. On the recommendation of Dan Dicker, I sold my new PSX shares, at the open, for a net of $33.99 a share. PSX closed today at $30.10. Dicker told me that I could work off what I owed him by writing an Amazon review of his book, "Oil's Endless Bid", which I did.

My Amazon Review of "Oil's Endless Bid"

By the way, last Tuesday, COP spun off PSX shares on a one for two basis. On the recommendation of Dan Dicker, I sold my new PSX shares, at the open, for a net of $33.99 a share. PSX closed today at $30.10. Dicker told me that I could work off what I owed him by writing an Amazon review of his book, "Oil's Endless Bid", which I did.

My Amazon Review of "Oil's Endless Bid"

Friday, April 27, 2012

Holding on to yesterday

After a big up day yesterday, the portfolio drifted today, but ended up a solid 1.03% since Wednesday.

Up for the week and the year, down for the month of April.

Up for the week and the year, down for the month of April.

Friday, April 20, 2012

Tuesday, April 17, 2012

A Sign From On High

Today, GOOG closed at $609.57 and AAPL closed at $609.70.

Is this a sign from Yahweh? Or just business as usual in the options pits?

Is this a sign from Yahweh? Or just business as usual in the options pits?

Thursday, April 12, 2012

I'll take it!

GOOG ran up $15 a share into earnings today, and the action was validated by a solid beat on bottom-line earnings with flat revenue, year-over-year. At this writing, another $10 has been added to the price in after-hours trading.

The whole portfolio got jiggy from the get-go this morning and never let up, for an overall gain of 2.16% on the day.

It's not Hallelujah Land yet, but it's getting there.

The whole portfolio got jiggy from the get-go this morning and never let up, for an overall gain of 2.16% on the day.

It's not Hallelujah Land yet, but it's getting there.

Wednesday, April 11, 2012

Google Eve

Why is this night different from all other nights?

It's Google Eve—Passover for GOOG.

You may have noticed that I have not made any posts this week. I have been in seclusion, meditating on whether or not GOOG will be passed over again this earnings season. Tomorrow evening, the analysts who can't shoot straight will have more than four questions about what is going on with this unappreciated company.

We the children of Google will be looking to Larry Page, once again, to post a good result and lead us out of the wilderness to the very gates of Hallelujah Land.

It's Google Eve—Passover for GOOG.

You may have noticed that I have not made any posts this week. I have been in seclusion, meditating on whether or not GOOG will be passed over again this earnings season. Tomorrow evening, the analysts who can't shoot straight will have more than four questions about what is going on with this unappreciated company.

We the children of Google will be looking to Larry Page, once again, to post a good result and lead us out of the wilderness to the very gates of Hallelujah Land.

Monday, April 9, 2012

Tuesday, April 3, 2012

Subscribe to:

Comments (Atom)